Bryant Nielson | April 11, 2024

In the ever-evolving landscape of blockchain technology and finance, a new hybrid has emerged, merging the seemingly divergent worlds of Centralized Finance (CeFi) and Decentralized Finance (DeFi). This innovative amalgam, known as Centralized Decentralized Finance (CeDeFi), promises to harness the strengths of both sectors to forge a more inclusive, efficient, and secure financial ecosystem. This article, crafted for aficionados and novices alike, delves deep into the essence of CeDeFi, exploring its mechanisms, potential, challenges, and its pivotal role in shaping the future of finance.

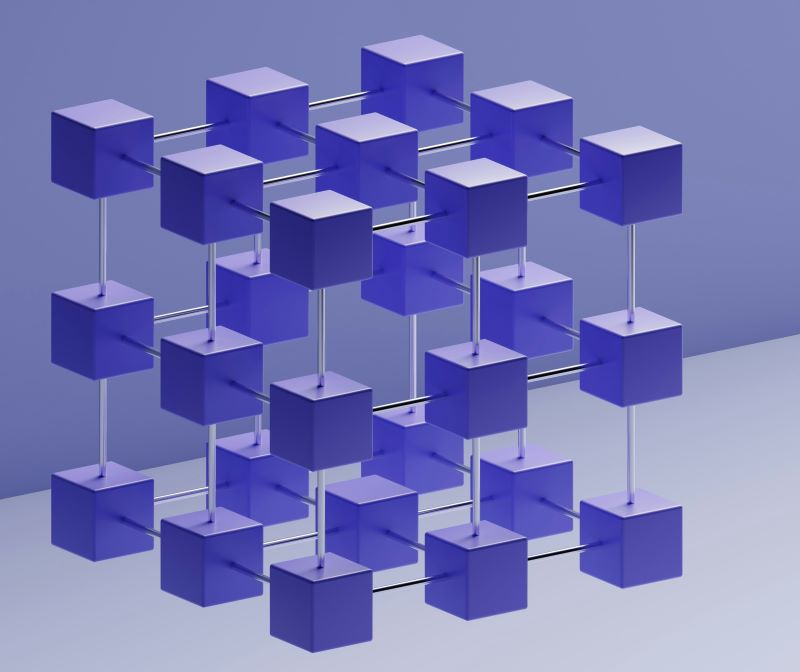

CeDeFi: A Hybrid Harmony

At its core, CeDeFi is a concept that seeks to blend the centralized control and user-friendly aspects of CeFi with the transparency, inclusivity, and security of DeFi. By doing so, it aims to create a financial ecosystem that leverages the best of both worlds, offering a balanced approach to digital finance.

Key Components of CeDeFi:

Centralized Oversight: CeDeFi platforms often operate under the stewardship of a central authority or company, ensuring compliance with regulatory standards and providing a safety net for users.

Decentralized Mechanisms: Despite the centralized control, CeDeFi incorporates decentralized technologies like smart contracts and blockchain, facilitating transparent and trustless transactions.

The Promise of CeDeFi

Accessibility and Ease of Use: By integrating the user-friendly interfaces and support systems characteristic of centralized platforms, CeDeFi makes blockchain technology and digital finance more accessible to the general public.

Regulatory Compliance: CeDeFi platforms can operate within regulatory frameworks, ensuring legal compliance and fostering trust among users and institutions alike.

Innovation and Efficiency: The incorporation of decentralized protocols accelerates innovation, reduces transaction costs, and enhances efficiency within the financial ecosystem.

Navigating the Challenges

Despite its potential, CeDeFi faces significant challenges that must be addressed to realize its full promise:

Balancing Control and Freedom: Finding the right balance between centralized governance and decentralized autonomy is crucial for the success of CeDeFi.

Regulatory Hurdles: Navigating the complex and evolving regulatory landscape poses a significant challenge for CeDeFi platforms.

Security Concerns: While aiming to combine the security features of DeFi with the reliability of CeFi, CeDeFi must ensure robust security measures to protect against both traditional and novel cyber threats.

CeDeFi in Action: Case Studies

Several pioneering platforms and initiatives have already begun exploring the CeDeFi space, each contributing unique solutions and insights:

1. Binance Smart Chain (BSC): BSC offers a high-performance blockchain that supports smart contracts and decentralized applications (dApps), operated by the centralized entity Binance, showcasing how centralized platforms can foster a decentralized ecosystem.

2. Uniswap with Centralized Onboarding: Platforms like Uniswap, while fundamentally decentralized, are exploring ways to integrate centralized onboarding processes to enhance user experience and compliance.

The Road Ahead

As the financial world stands at the cusp of a new era, CeDeFi presents a promising path forward, offering a synthesis of centralization’s reliability and decentralization’s innovation. For industry leaders, regulators, and enthusiasts, the journey towards a mature CeDeFi ecosystem will require collaboration, creativity, and a commitment to navigating the intricate balance between governance and freedom.

In conclusion, CeDeFi is not merely a transient trend but a significant step towards a more inclusive, efficient, and secure financial future. As we delve deeper into this hybrid domain, the potential for transformation and growth is boundless. The fusion of centralized ease and decentralized ethos in CeDeFi marks a pivotal moment in the evolution of finance, promising to redefine our engagement with the digital economy.